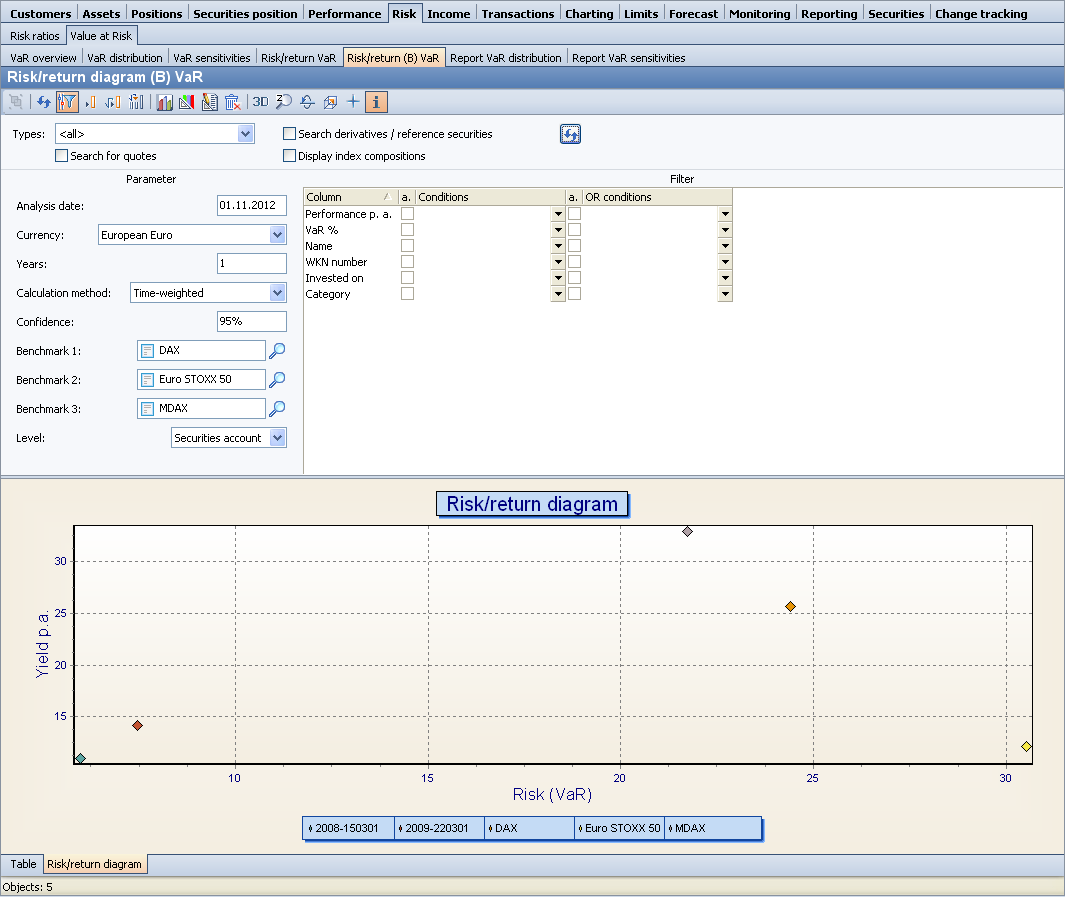

Risk-return diagram (B) VaR

Module "Portfolio Service Extended Portfolio Analysis"

This evaluation is structured in the same way as the "old" Risk-return diagram (benchmark) , except that the risk is measured using the VaR instead of the vola.

Parameters of the risk-return diagram (B) VaR

Parameters | Description |

|---|---|

Evaluation date | Evaluation date of the evaluation, which you can enter in the form "dd.mm.yy". The default setting is the current date or the evaluation date entered in the input field on the "Start" tab. |

Currency | Evaluation currency in which the VaR is determined (and against which the exchange rates of the individual instrument currencies are determined). The default setting is the default evaluation currency of the input object (e.g. holder). |

Calculation type | For the performance calculation, the calculation type can be set between "Internal interest rate", "Classic" (approximation), "Time-weighted" (exact) and "Time-weighted cum equity". Information on the exact definition of these variables can be found in the section Calculation of performance. |

Years | Use this parameter to select the period in years over which risk and performance are to be calculated. The default setting is one year. |

Confidence | Probability that the amount of losses in the forecast period will not exceed the VaR. |

Level | In this selection list, select whether the chart is to be displayed at portfolio, holder or custody account level. |

Benchmark 1 to 3 | Select up to 3 different comparison values for the diagram. |