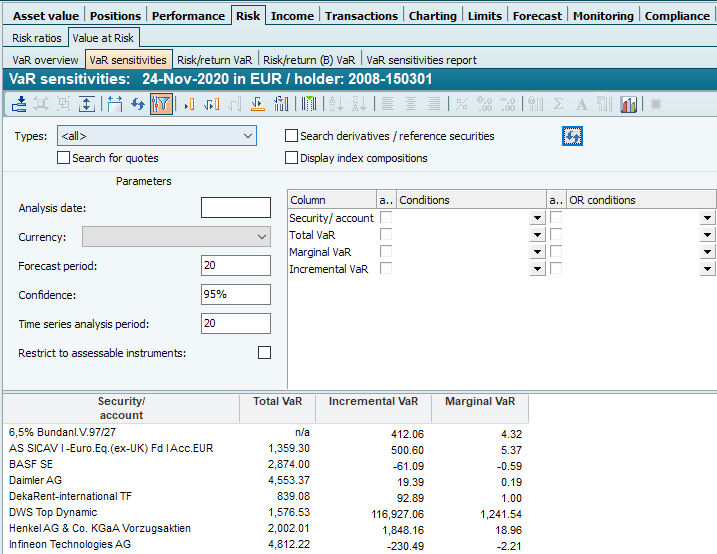

VaR sensitivities

Module "Portfolio Service Extended Portfolio Analysis"

This analysis presents two important key figures in the context of value at risk: One is the marginal VaR and the other is the incremental VaR. Both key figures relate to a portfolio position in the context of its portfolio.

The marginal VaR indicates how much (in a linear approximation) the total VaR will increase in absolute terms if the position is increased by 1%.

Incremental VaR is the contribution that a portfolio position makes to the overall portfolio, i.e. the difference between the VaR of the portfolio without this position and the portfolio itself. The incremental VaR is therefore always less than or equal to the VaR of the individual portfolio position. It can also be negative.

Parameters of the VaR sensitivities

Parameters | Description |

|---|---|

Evaluation date | Evaluation date of the evaluation, which you can enter in the form "dd.mm.yy". The default setting is the current date or the evaluation date entered in the input field on the "Start" tab. |

Currency | Evaluation currency in which the VaR is determined (and against which the exchange rates of the individual instrument currencies are determined). The default setting is the default evaluation currency of the input object (e.g. holder). |

Forecast period | Period for which the VaR is determined (see Definition of value at risk). The information is given in periods (trading days). |

Confidence | Probability that the amount of losses in the forecast period will not exceed the VaR. |

Time seriesanalysistime period | Use this parameter to specify how many periods of the historical time series should be used for parameter estimation. The information is given in periods (trading days). |

Restriction to instruments that can be valued | If you activate this checkbox, the VaR is only calculated on the measurable instruments, i.e. the result is always a value. Non-valuable instruments are simply not taken into account. |

Evaluation date | Evaluation date of the evaluation, which you can enter in the form "dd.mm.yy" The default setting is the current date or the evaluation date entered in the input field on the "Start" tab. |