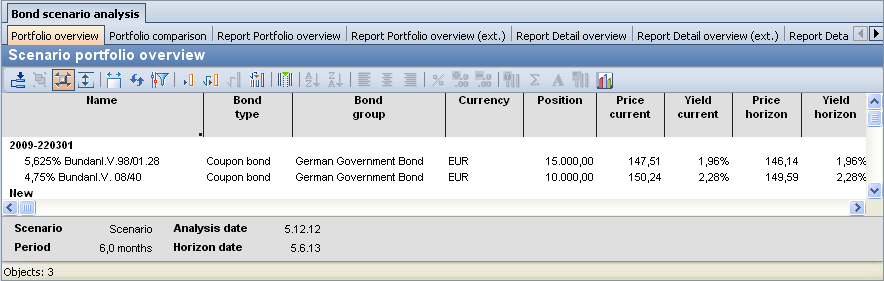

Scenario portfolio overview

Bond scenario analysis" module

The "Scenario Portfolio Overview" gives you a perfect overview of your bond portfolio. All key figures are available for all bonds in the portfolio both for the evaluation date ("Current") and for the set horizon date.

The columns of the "Scenario portfolio overview" in detail:

| Column | Description |

|---|---|

Name | The security name of the bond. |

Bond type | The type of bond according to the master data. |

Bond group | The bond group (sector) of the bond according to the master data. |

Currency | The currency of the bond according to the master data. |

Stock | The amount of the bond in the portfolio on the evaluation date. |

Current course | The current price of the bond on the evaluation date. |

Current yield | The current yield of the bond on the evaluation date. The yield method is the standard ISMA methodfor all bonds (including floaters). Regional particularities are not taken into account. |

Course Horizon | The calculated course at the horizon date. |

Yield horizon | The calculated return on the horizon date. Simplified formula: Yield horizon = future equivalent government bond yield + current credit spread + change in credit spread |

Total return | The total return (the "absolute return"), here in relation to the analysis period. The total return is the annualized internal rate of return of the portfolio. In a total return analysis, the portfolio and certain assumptions (parameters, reinvestment assumptions, trading strategies) are held until the investment horizon and the return is then calculated. |

Total return p. a. | The total return per year. |

Current exchange rate | The exchange rate between the currency of the bond according to the master data and the evaluation currency on the evaluation date. |

Exchange rate horizon | The exchange rate between the currency of the bond according to the master data and the evaluation currency on the horizon date, taking into account any shifts entered. |

Current market value | The market value of the bond position on the evaluation date. |

Market value horizon | The market value of the bond position at the horizon date. |

Without model | Securities that cannot be assigned to the calculation model are marked "*" in this column. Example: Reverse convertibles. |

Current portfolio weight | The percentage share of the bond in the total portfolio on the evaluation date. |

Portfolio weight Horizon | The percentage share of the bond in the total portfolio at the horizon date. |

Current accrued interest | The accrued interest of the bond on the evaluation date. Accrued interest is determined according to the master data recorded at Interest day method . |

Accrued interest horizon | The accrued interest on the bond at the horizon date. |

Repayment | Repayments due in the analysis period. |

Interest payments | The interest payments due in the analysis period. |

Reinvestmentinterest | The reinvestment interest to be taken into account in the analysis period. |

Current credit spread [bp] | The credit spread of the bond on the evaluation date in basis points. |

Credit spread horizon [bp] | The credit spread of the bond at the horizon date in basis points. |

Current remaining term | The remaining term of the bond on the evaluation date. |

Remaining term Horizon | The remaining term of the bond on the horizon date. |

BPV up to date | The basis point value of the bond on the evaluation date. The basis point value is the change in the bond price if the yield on the bond changes by one basis point. |

BPV Horizon | The basis point value of the bond at the horizon date. |

Current duration | The duration of the bond on the evaluation date. To calculate the key figure Duration, read the section Duration analysis. |

Duration horizon | The duration of the bond at the horizon date. |

Modified duration current | The modified duration of the bond on the evaluation date. To calculate the modified duration key figure, read the section Duration analysis. |

Modified duration horizon | The modified duration of the bond at the horizon date. |

Convexity up to date | The convexity of the bond on the evaluation date. In contrast to duration, this key figure takes into account the convex shape of the bond price trend depending on changes in market interest rates. Please refer to the more detailed calculation at Literature . |

Convexity horizon | The convexity of the bond at the horizon date. |

In the footer of this tabular evaluation, you will also find further information on the selected scenario and its parameters:

| Column | Description |

|---|---|

Name | The security name of the bond. |

Bond type | The type of bond according to the master data. |

Bond group | The bond group (sector) of the bond according to the master data. |

Currency | The currency of the bond according to the master data. |