Relative strength according to Levy

Type

Oscillator

Short introduction

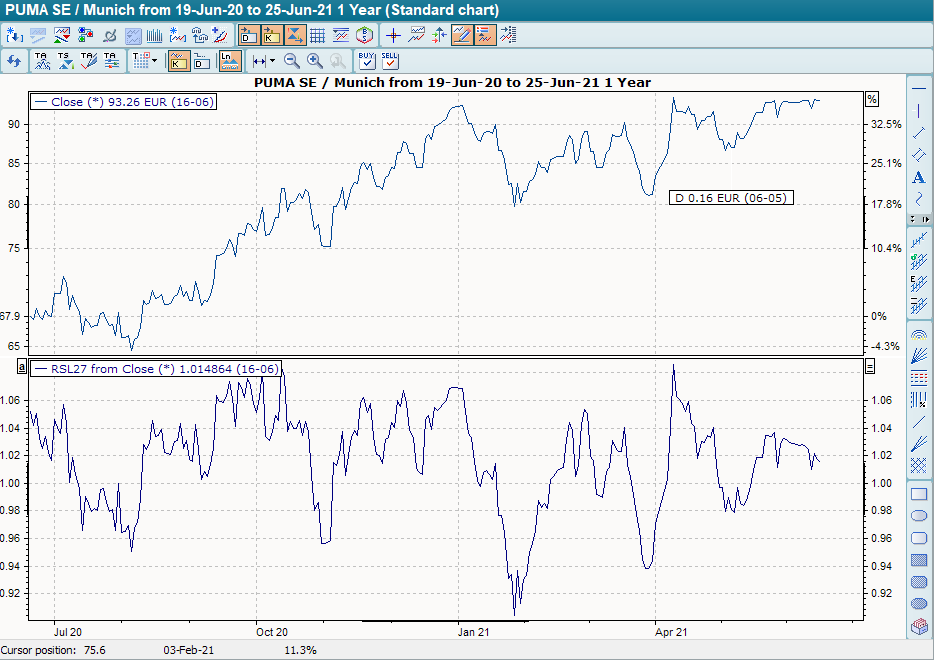

The Relative Strength (RSL) developed by Levy should not be confused with the Relative Strength Index (RSI). In his analysis, Levy assumes that prices that have developed positively in the past will also develop positively in the future. Relative strength therefore does not refer to a comparison with another security or index, but rather to the security itself.

Statement

To calculate the indicator, a GD is first formed and the current price is then divided by this GD. The result thus fluctuates constantly around the line at value "1".

Formula/calculation

Interpretation

The current RSL value of a security alone is of little significance, as it merely compares the current performance with past performance. A value greater than 1 indicates that the current performance is better, a value less than 1 indicates that the current performance is worse than in the past.

It makes more sense to calculate the RSL for several titles and compare these titles in tables. This is also the usual application for this indicator. In this case, Infront Portfolio Manager provides you with all the options for individual table design.

Default setting

- 27 weeks

Basic trading systems

- None