Modules

Portfolio Service Investment Agent" module or "Portfolio Service Rebalancing" module

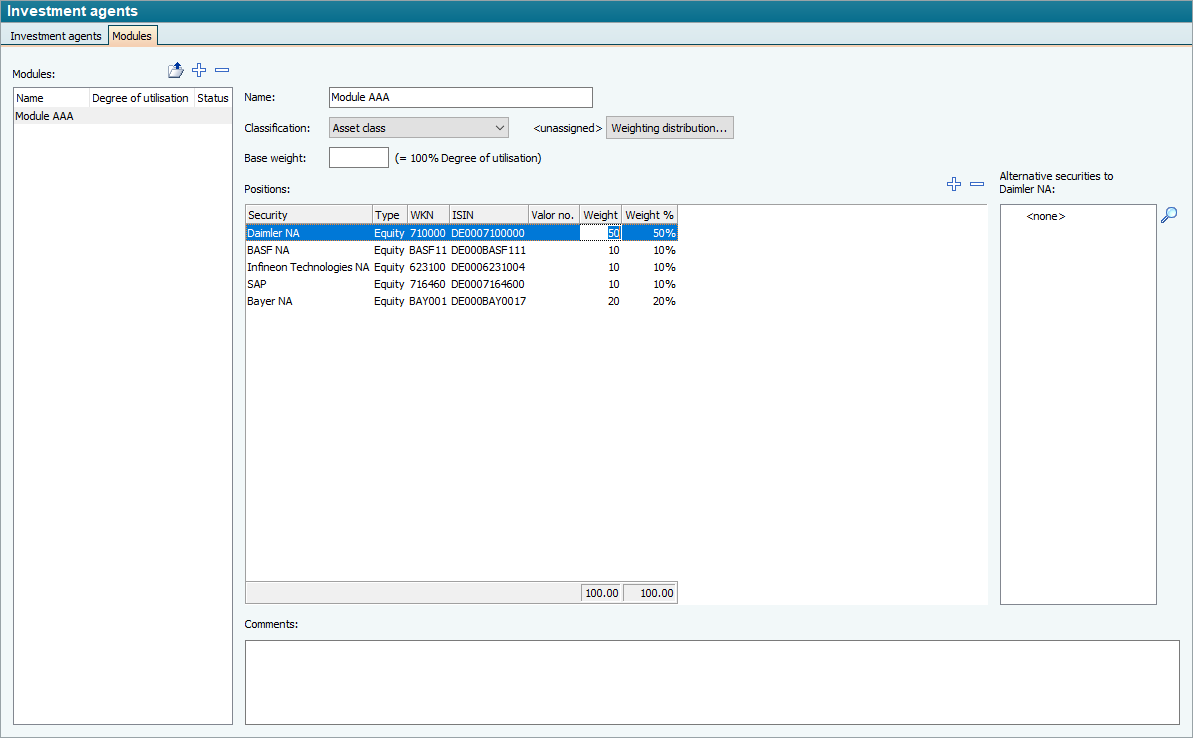

A module is essentially a named set of weighted portfolio positions. Portfolio positions consist of securities and not price quotations. A module is a constructive representation of how portfolios should be structured in an asset segment. Modules are combined to form module systems. A module is defined by:

- Name (system-wide unique, used for identification)

- List of securities with percentage target weighting

Each item has a list of permissible alternative papers. These alternative securities can replace the favored security if they are already part of a portfolio.

Modules are visible to all users in the Infront Portfolio Manager. You need the system right "Create, modify, delete investment agents" to design investment agents, i.e. to create new investment agents or modules, delete them or modify allocation formulas. Only the "Configure investment agents" system right is required to adjust module compositions, position weights, allocation formula parameters and other allocation settings. You can access modules using the MM-Talk formula language.