Asset class analysis (pre-trade)

Portfolio Service Investment Agent" module or "Portfolio Service Rebalancing" module

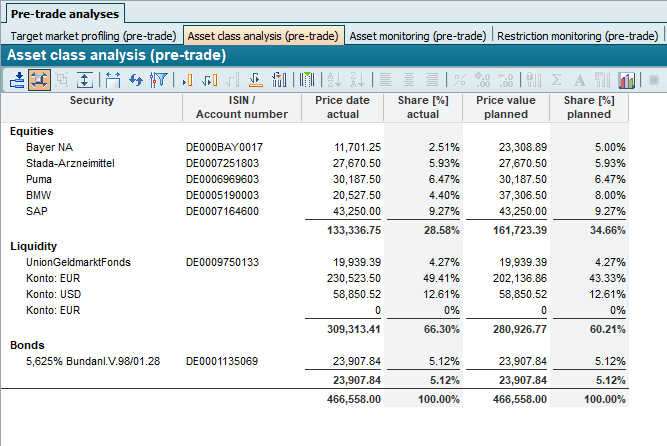

The "Asset class analysis (pre-trade)" is based on the familiar tabular analysis Asset class analysis. Optimized for rebalancing portfolios, the "Asset class analysis (pre-trade)" compares actual Actual and planned values for market values and shares in the portfolio. In addition to the tabular evaluation, two diagrams are also available for comparison.

The columns in detail:

| Column | Description |

|---|---|

Asset class | The table is grouped according to this column (hidden by default). Use the "Classification" parameter to select the breakdown, "Asset class" by default. It is also possible, for example, to break them down by region, sector or risk class. Please note the information on the "Classification" parameter in the section Parameters of the depot analyses. For background information, please also read the chapter Edit basic asset classes and asset classifications. |

Securities | The name of the security. For securities positions for which asset class splitting applies and which are therefore distributed across several rows, you will also see the percentage share of this position (x %) here. If necessary, please also read the sections Parameters of the depot analyses ("Classification" parameter) and Create new asset classification. |

ISIN/Account number | In this column you will see the ISIN for securities and the account number for accounts ("Liquidity" asset class). |

Actual market value | The actual market value of the respective securities position. For securities positions for which asset class splitting applies and which are therefore distributed across several lines, this value is multiplied by the corresponding weight. |

Share [%] Actual | The percentage share of the respective security position in the actual value of the rebalancing portfolio. For securities positions for which asset class splitting applies and which are therefore distributed across several lines, this value is multiplied by the corresponding weight. |

Market value plan | The planned market value of the respective securities position. For securities positions for which asset class splitting applies and which are therefore distributed across several lines, this value is multiplied by the corresponding weight. |

Share [%] Plan | The percentage share of the respective security position in the planned value of the rebalancing portfolio. The planned value of the rebalancing portfolio may deviate from the actual value (e.g. due to consideration of the savings rate from the configuration of the investment agent). For securities positions for which asset class splitting applies and which are therefore distributed across several lines, this value is multiplied by the corresponding weight. |

Siehe auch: