Signal system properties (Editor)

Module "Advanced Technical Analysis"

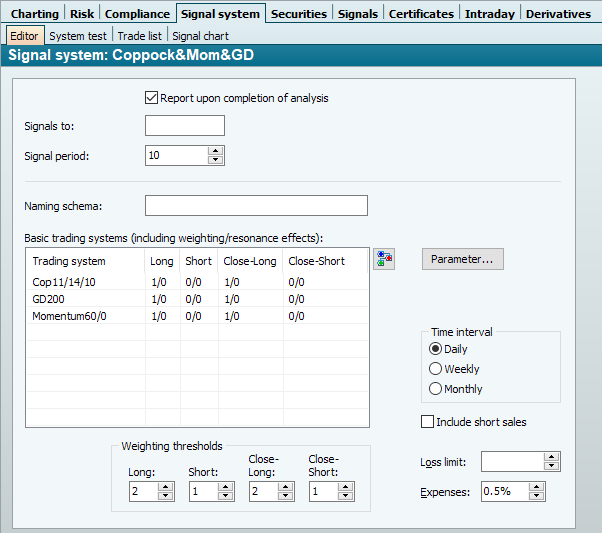

This section describes all the input fields in the signal system editor.

| Field | Description |

|---|---|

Message at the end of evaluation | [Enabled by default] Activate the checkbox if you want the table of signals to be displayed immediately after the signals have been evaluated. |

Signals up to | Date up to which signals are calculated (only in the Explorer object, independent of the chart). If you do not enter anything here, the current date (computer date) applies. |

Signal period | Number of periods (days, weeks, months, according to the time interval) over which signals are to be calculated before the end date(see "Signals to"). For testing purposes, a period of 120 to 250 days (approx. 6 trading months to 1 trading year) is recommended. If you are then satisfied with your system, you should adjust the period to your data update cycle, e.g. daily or weekly (5 days). |

Designation scheme | Scheme of the system designation in the chart legend. In addition to fixed text, you can add dynamic text here (with the syntax $Parametername$). The resulting text is placed after the signal system name. |

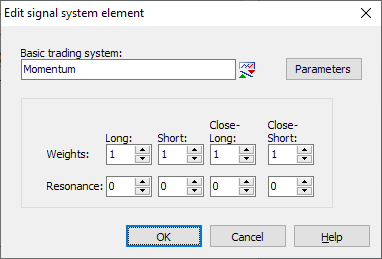

| By selecting a basic trading system or via the "Edit signal system element" icon to the right of the table, you can access the "Edit signal system element" dialog box to define the selected basic trading system.

|

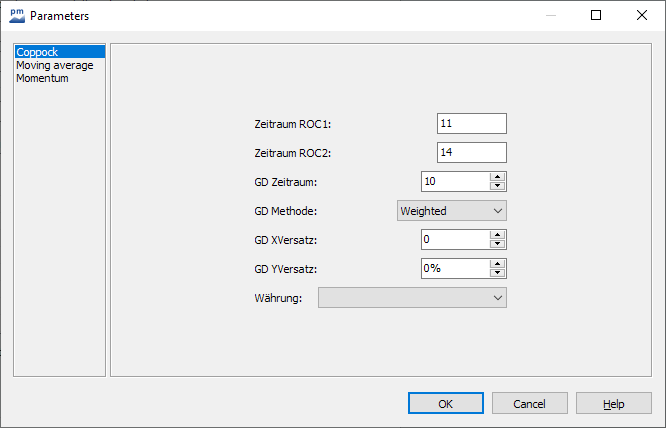

Parameters | Here you can modify the parameters for all listed basic signal systems.

|

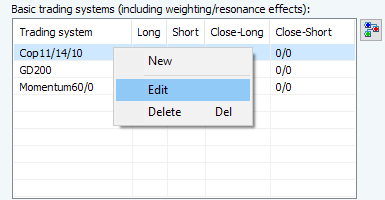

List field "Basic trading systems with weights/reverb" | Displays the trading systems to be combined with the 4 weights. Entries can be added, edited and deleted via the context menu.

|

Time interval | Indication of whether the trading systems are to be evaluated on a daily, weekly or monthly basis. As a rule, a signal system is calculated on a daily basis. |

Include short sales | Setting for the performance evaluation in the chart. As a rule, short selling is only recommended for stocks for which you can also buy options, as this is the only way to sell short on the stock exchange. You should also take this into account when compiling your input folders. |

Loss limit | In [%] Setting for the performance evaluation in the chart. With technical systems in particular, you should set a stop in order to limit losses. The tighter the loss limit, the more short-term (and thus the narrower the price fluctuations) you have planned your system. For very short-term systems, you could set the loss limit to 3%, for example, or to 10% or 15% for longer-term systems. |

Expenses | In [%] Setting for the performance evaluation in the chart. This information is very important, because especially with systems that deliver many signals with relatively low percentage successes, the expenses can drastically reduce the return or even turn it into a loss. |

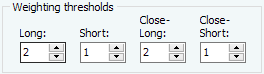

Weight thresholds | Signal systems are specified by a list of basic trading systems, whereby a weight value is specified for each element for each of the four signal types. In addition to the list, there is a total threshold value for each signal type that must be reached for the combination to generate a signal. A combination is therefore evaluated as follows: Signals are determined for each sub-trading system. Each of these signals generates a weight according to the weights of the list entry. The following applies for each signal type: if the sum of the weights for this signal type on one day is greater than or equal to the threshold value for this signal type, the combination provides a signal of this type on this day.

Beispiel: Kombination eines RSI mit Long-Gewicht 1 mit einem Momentum mit Long-Gewicht 1 With a long threshold of 1, the combination provides long signals if one of the indicators signals long. With a long threshold of 2, on the other hand, the combination provides long signals if both indicators signal long. |