Model portfolios and investment agent configuration

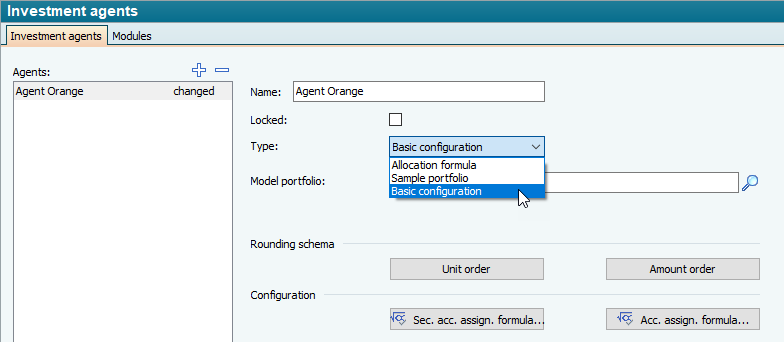

There are three types of investment agents:

- Allocation formula

This type stands for the conventional mode with allocation formula, allocation parameters and user field category.

- Model portfolio

Here, the target portfolio is defined by the holdings and liquidity of a model portfolio. The model portfolio is assigned to the investment agent. The "Rounding Scheme" and "Configuration" sections in the "Investment Agents" worksheet are also available for this type.

- Basic configuration

The basic configuration contains the allocation parameters that have nothing to do with the definition of a target portfolio. These are stored as a configuration for manual ordering or ad hoc reallocation. Examples of this are the rounding scheme or the securities account allocation strategy.

For example, if you have opened the "Investment agents" worksheet via the "Configure investment agents" icon on the "Ordering" tab in the ribbon, select the type for the selected investment agent via the "Type" selection list.

For details, read the section Configure investment agents.