Invest fixed-term deposits

You can manage your fixed-term deposits with the Infront Portfolio Manager. Fixed-term deposits are classified as special investments.

To invest fixed-term deposits, proceed as follows:

- Open the "Enter transactions" worksheet as described in the section Enter transactions and select the desired holder or portfolio if necessary.

- Open the ACCOUNT menu in the "Enter transactions" worksheet.

- Select the transaction type CREATE FIXED MONEY at Account transaction types .

Use the keyboard to create fixed-term deposits with the "Enter transactions" worksheet open as follows: Press the key combination <CTRL>+<2> for the account transaction types. Then press the button<C>.

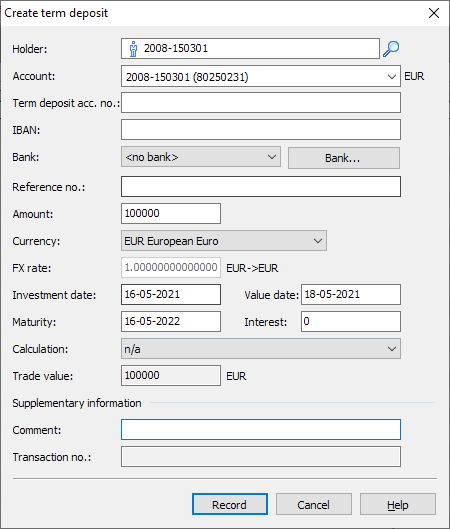

The "Create fixed-term deposit" dialog box appears.

- Complete or change the information in the input fields if necessary. The details of these fields can be found in the following table.

The fields in detail:

Element

Description

Holder

If necessary, select a (different) holder here.

Account

If necessary, select a (different) account here.

Fixed-term deposit account no.

Enter the account number of the fixed-term deposit account here.

IBAN

Enter the IBAN of the account here.

Bank

Select the bank of the account here. Click on the "Bank..." button to open the familiar "Manage bank details" dialog box, in which you can create new bank details if necessary.

Please read the section Bank details.

Reference no.

If the transaction was imported via a Portfolio Sync Interface, you may find the corresponding reference number here.

Amount

Enter the amount of the fixed deposit in this field.

Currency

Enter the currency in which the fixed-term deposit has been invested.

The default is the currency of the specified account.

Exchange rate

Enter the exchange rate at which you purchased the fixed-term deposit here if it is not the same as the account currency.

The "direction" of the exchange rate is freely selectable.

Investment date

Date on which the fixed-term deposit was invested. The current date is specified.

You can change the date (dd.mm.yy), e.g. to make retroactive postings.

Value date

Enter the value date here. Interest on fixed-term deposits is then calculated from the value date.

Maturity

Enter the maturity date of the fixed-term deposit in this field. The default setting is "Start date + 30 days", i.e. monthly allowance.

Interest

Enter the interest rate you receive for your fixed-term deposit here. The interest rate must include the annual interest rate, regardless of the term of the fixed-term deposit. Enter a real percentage, such as 3.75.

Calculation

Specify here how the interest is to be calculated.

If necessary, read the section Interest day method.

Ausm. Amount

The amount resulting from the investment amount.

Remark

If necessary, enter a comment on the fixed-term deposit in the input field. To do this, click in the input field and enter your text using the keyboard.

Transaction no.

If the fixed-term deposit is made via

, you will see the transaction number here, which is used to identify the transactions.

- Finally, confirm the entries with the "Enter" button.