The "Performance attribution" evaluation

Module "Portfolio Service Extended Portfolio Analysis"

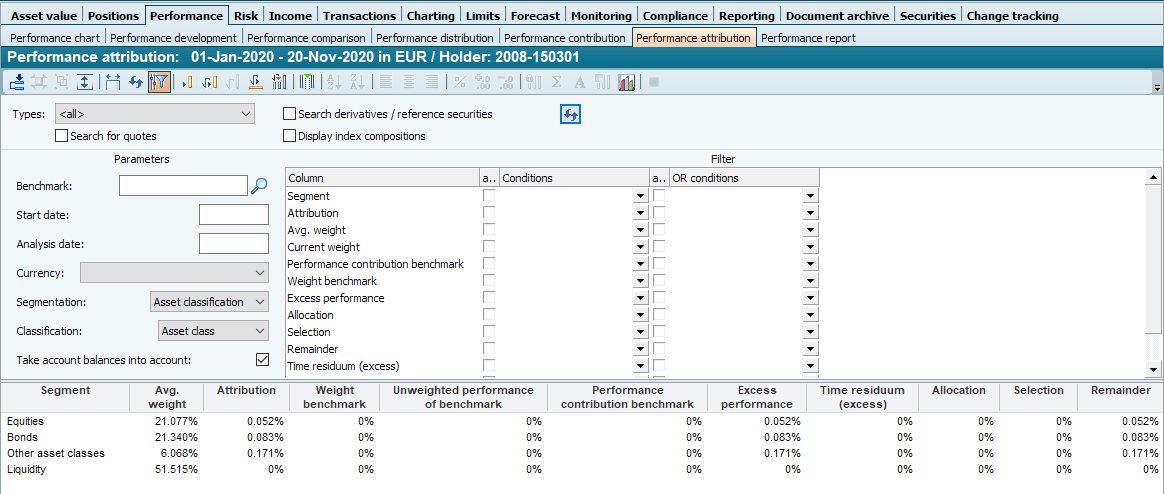

The excess performance is calculated by comparing the individual segment performance values with a similarly segmented benchmark. The associated evaluation is the performance attribution.

If you have stored a "benchmark history" via the historicized portfolio versions of the portfolio, this history is also taken into account in the "Performance attribution" evaluation (if all the benchmarks stored are securities of the "Index" type).

You can find the "Performance attribution" evaluation in the workspace of portfolios, owners or groups on the "Performance" worksheet, for example.

A benchmark can also be divided into different segments in line with the portfolio. Infront Portfolio Manager uses the securities and weightings defined in the index composition (see the section Benchmarks).

The composition can either include individual securities (shares, bonds, etc.) or indices that reflect the performance of an entire segment (e.g. MSCI regional indices).

Compared to the "Performance attribution" evaluation, the "Performance attribution" contains the following additional columns:

Column | Description |

|---|---|

Benchmark weight | Percentage share of the respective segment in the benchmark. |

Benchmark performance contribution | The "Benchmark performance contribution" is calculated in the same way as for the portfolio. The same period allocation applies as for the portfolio (for the portfolio, this results from reallocations, income and exogenous movements in funds). |

Unweighted performance of the benchmark | The unweighted performance of the benchmark in the set period. |

Surplus performance | The excess performance is the difference between the performance contribution of the portfolio and the performance contribution of the benchmark in the respective segment, linked geometrically by period. |

Time residual (surplus) | The time residual (surplus) resulting from the calculation of the surplus performance. If necessary, read the section Residual terms of the multi-period attributionfor the calculation. |

Allocation | Effect of weighting the segments compared to the benchmark. For details, read the following section Allocation and selection. |

Selection | Effect through the selection of individual stocks in the respective segment. |

Rest | As the overall performance cannot be clearly divided between allocation and selection contributions, there is a residual contribution for each segment. |

Time residual (contributions) | The time residual (contributions) resulting from the calculation of the excess performance from "allocation", "selection" and "residual". If necessary, read the section Residual terms of the multi-period attributionfor the calculation. |

It should be noted that such benchmarks are only suitable for exactly one setting of the segmentation parameter of the performance attribution; a performance attribution by sector in combination with a benchmark from region indices does not provide any useful results.

Siehe auch: