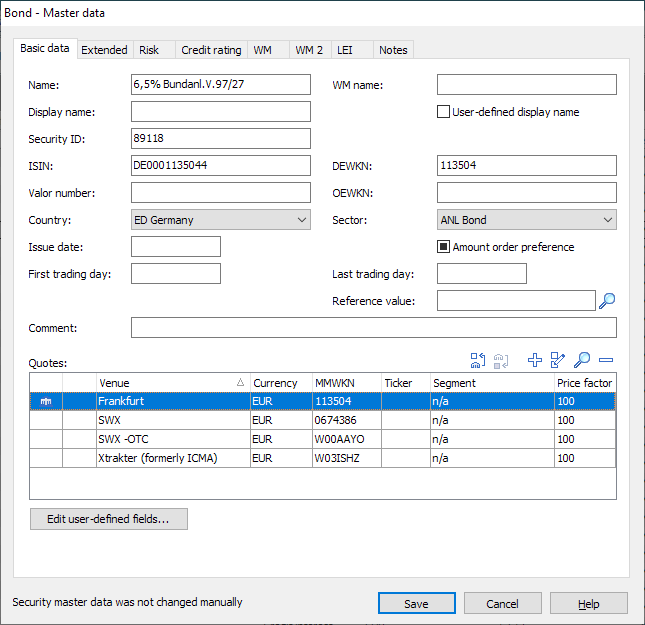

Bond master data

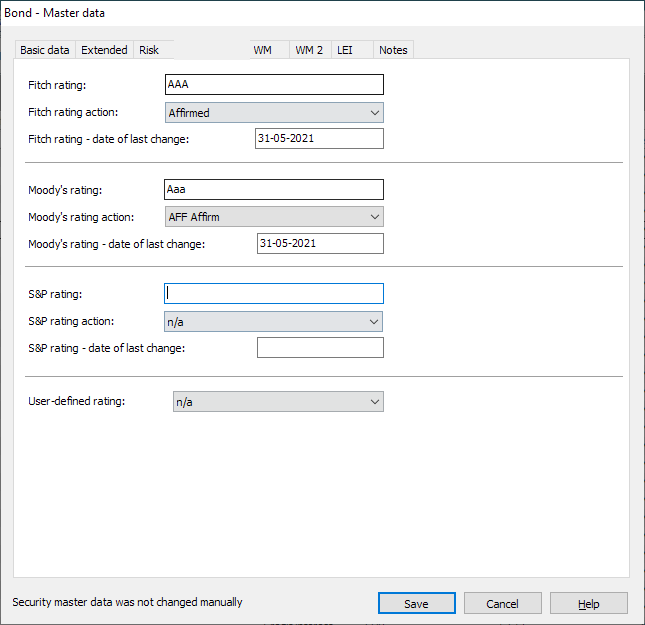

Rating for bonds

In the bond master data, you will find all rating information on the "Credit rating" tab.

The complete data on Fitch, Moody's or Standard & Poor's ratings is only available in conjunction with the fee-based modules "Moody's bond ratings", "Fitch bond ratings" or "S&P bond ratings".

The user-defined rating, on the other hand, can be maintained individually.

Interest rate history

No histories can be created for zero bonds and bonds of type "n/a", the icon is therefore deactivated in these cases. If you click on the "Edit interest history" icon and no interest history exists yet, the program offers to automatically generate an interest history from the master data if the following master data exists:

- First trading day (issue date)

- Runtime

- Interest interval

The interest payment date, if not available, is the 1. 1. used. When generating the interest history, the first entry in the interest history corresponds to the issue date and the last entry to the term. In between, interest is added according to the interest date and interval. The interest rate is set for each entry according to the master data "Interest rate".

If the necessary master data (first trading day, etc.) is missing in whole or in part, you can also create the interest history manually.

After automatic generation, a dialog box opens which displays the generated interest history in a table view. If the interest history has not been generated, the table view is empty. In any case, you can edit the interest history manually in this dialog box.

To enter the data manually, please also read the chapter Histories.

You can edit both the date and the interest rate. It is always possible to change the interest rate, but this is generally only advisable for floaters.

The checkbox "Dates in history are payment dates" influences the behavior of the history when calculating accrued interest and cash flow.

If the checkbox is activated, the entries in the history are interpreted as single payment dates. This makes it possible to map special cases such as long first coupons or defaulted payments.

If the checkbox is deactivated, the data records in the history are only interpreted as interest rate changes and not as payments. The payment dates are calculated according to the existing settings on the "Advanced" tab.

Pool factor bonds

General information on the pool factor

The pool factor is the factor by which a (pool factor) bond is repaid in installments on regular dates. The pool factor therefore provides information on the redemption status of a bond. Initially, this is 1 (i.e. 100% of the nominal amount outstanding) and runs towards 0 as repayment increases. A pool factor of 0.4 means that 40% of the nominal value is still outstanding. If a pool factor bond is partially redeemed, the nominal value is not reduced, but the pool factor is reduced accordingly.

The pool factor must therefore be taken into account in a number of calculations. This concerns (without any claim to completeness):

Interest

Market values of open positions

Key risk figures

..

Pool factors in the Infront Portfolio Manager

If the bond is a pool factor bond, activate the "Bond has pool factor" checkbox on the "Advanced" tab in the "Master data" dialog box.

The pool factor repayment is available as a separate transaction type in the Infront Portfolio Manager. In addition to the usual details (transaction type, holder, custody account, depository, account, closing date, value date, security, transaction currency, etc.), the "Pool factor repayment" dialog box also asks for the exchange rate, the exchange rate and the new pool factor.

A pool factor repayment can only be entered if the security was previously stored with a pool factor (i.e. only if the "Bond has pool factor" checkbox is set at master data level).

The pool factor is calculated on a transaction basis, i.e:

the initial pool factor is set when a pool factor bond is purchased

in the case of a pool factor repayment, the new pool factor is set (whereby only the difference between the old and new pool factor is saved here)

Entering a pool factor repayment in the Infront Portfolio Manager does not automatically lead to the new pool factor being stored in the securities master data.

The pool factor stored at master data level has no relevance for the pool factor repayment or for the calculations at portfolio level.

Bonds without accrued interest

The accrued interest calculation is disruptive for some bonds. You have the option of suppressing the accrued interest calculation in order to achieve a correct presentation of assets in tables and reports. To do this, set the calculation method in the "Interest days" selection list to "flat" to suppress the calculation; the result is then 0.

Index-linked bonds

Among the bond types that you can select on the "Advanced" tab of the bond master data, you will also find the "Indexed" type.

Indexed bonds are bonds whose issue denomination or interest payments (e.g. floating rate notes) or redemption (e.g. equity index bonds) are linked to an index. Possible indices include the inflation rate, share price performance or changes in currency parities.

For index-linked bonds, the interest rate is the prime rate without offsetting the ratio.

Index-linked bonds can have different values in the securities list and the statement of assets, for example. While the securities list "only" shows the price, these bonds are valued in the statement of assets taking into account the "indexation coefficient".

The nominal value is multiplied by a factor that reflects the inflation rate, for example.

Non-performing bonds

On the "Extended" tab of the bond master data, you can mark bonds as "Non-performing" and enter a date from which the bond is to be considered non-performing.

Defaulted bonds are bonds where the debtor (issuer) is no longer in a position to pay the current interest payments or to repay the bond amount on maturity or early termination by the creditor (investor), i.e. the debtor is insolvent.