Short straps and short strips

| Range | Value |

|---|---|

Market expectation | (Strongly) decreasing volatility |

Construction | x puts short |

Construction | x Calls Short |

Profit potential | Limited |

Risk of loss | Unlimited |

Time effect | Positive |

Volatility effect | Negative |

Market expectation

Short straps and short strips are based on the expectation of unchanged prices and a sharp decline in volatility. The difference is that short strips are preferable if you do not expect prices to fall under any circumstances, and short straps if you do not expect prices to rise under any circumstances.

Construction

Starting from a short straddle, additional calls are sold in the case of a strap, whereas additional puts are sold in the case of a strip. Depending on expectations, more options are sold accordingly. You can select standard defaults after selecting a short strip or short strap in the "Option strategy optimization" dialog box: 1:2, 2:3, 2:5, 1:3. Only these constellations are then displayed in the evaluation table.

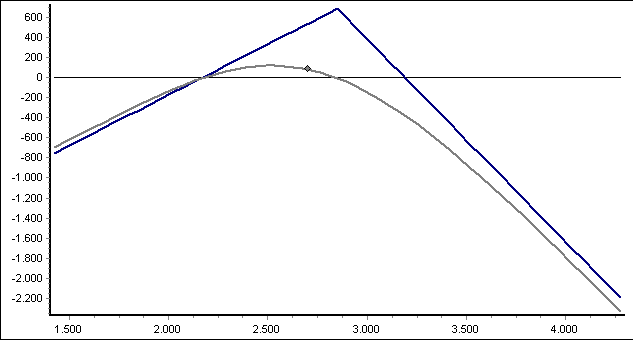

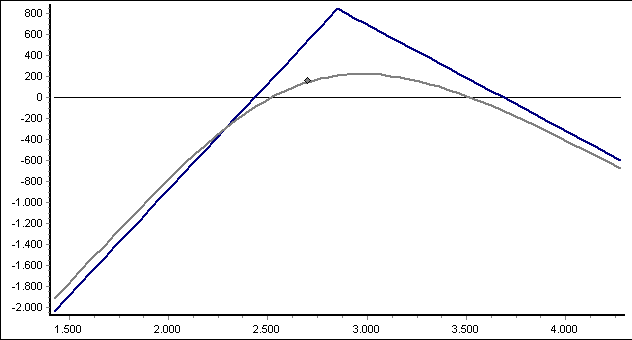

Profit potential

The profit potential is limited to the option premiums received. However, it is higher than with a short straddle, as more calls or puts are sold.

Risk of loss

The risk of loss of the positions is unlimited. There is a risk of loss if prices change significantly.

A short strap quickly loses value, especially if prices rise sharply contrary to expectations, and the short strip loses value if prices fall sharply.

Time effect

Since only options are sold, the time value is clearly positive. The positive time value is maximum if the price of the underlying is quoted at the strike price and the remaining term is very short.

Volatility effect

The volatility effect is negative. The risk of loss increases with increasing volatility, as price changes become more likely. Accordingly, closing out the position also becomes more expensive.