Short straddle

| Range | Value |

|---|---|

Market expectation | Unchanged share prices |

Construction | Call Short |

Profit potential | Limited |

Risk of loss | Unlimited |

Time effect | Positive |

Volatility effect | Negative |

Market expectation

A short straddle is suitable if you expect the price of the underlying to stagnate with falling volatility.

Construction

The short straddle consists of a call short and a put short with the same strike price and the same remaining term.

Profit potential

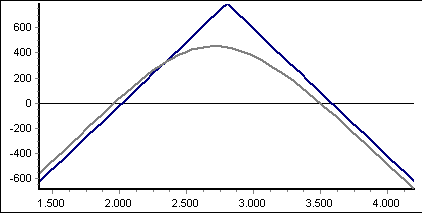

The profit potential of a short straddle is limited. The maximum profit is limited to the sum of the premiums received. It is achieved if the price of the underlying asset is quoted at exactly the same level as the underlying asset on the expiry date.

The lower break-even point is the base price minus premiums received, the upper break-even point is the base price plus premiums received.

Risk of loss

The risk of loss of a short straddle is unlimited. If the price rises above the upper break-even point, the put short expires, but the call short is subject to unlimited losses. If the price falls below the lower break-even point, the call expires and (virtually) unlimited losses are then threatened by the put short.

Time effect

As a short position is taken in both positions, the fair value effect is positive. The effect is strongest when the price of the underlying is close to the strike price.

Volatility effect

The volatility effect of the short straddle is clearly negative. The risks increase if volatility rises.