Report Performance report

You can find the "Performance report" in the workspace of a portfolio on the "Reporting", "Performance" worksheet, for example.

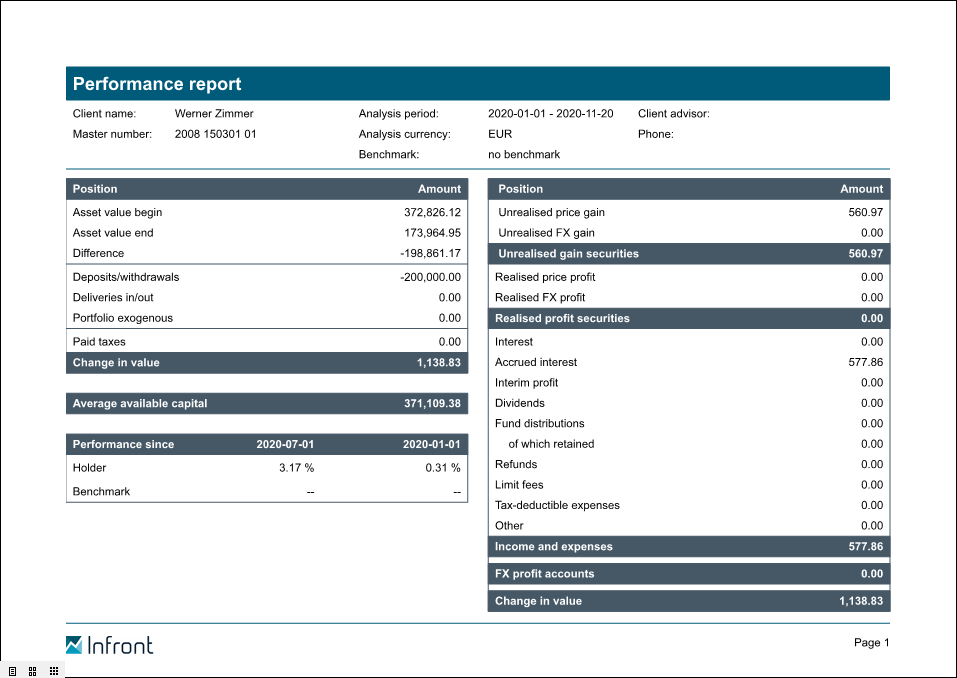

The "Performance Report" provides a good overview of the changes in a client's assets over a specific period. It describes the asset status at the beginning and end of a period as well as the absolute and percentage performance.

Performance can be calculated on a money-weighted basis (classic), time-weighted and using the "time-weighted cum equity" and "internal interest rate" methods. If necessary, read the Calculation methodschapter to calculate the performance. To change the calculation type, proceed as follows:

- On the "Report" tab, select the DISPLAY PARAMETERS command in the menu of the "Parameter" icon or press <CTRL>+<A>.

- In the "Parameters" dialog box, select the desired entry in the "Calculation type" selection list.

- Confirm with "OK".

The Infront Portfolio Manager automatically updates the opened "Report Performance Report".

The difference in assets is also made transparent by stating realized/unrealized gains as well as income and expenses.

The details of the individual items can be found in the following table:

Column | Description |

|---|---|

Performance report | The title of the report. |

Customer name | The name of the owner from the address. |

Portfolio number | The portfolio number entered in the "Portfolio no." field in the portfolio master data. |

Account manager | The name of the account manager. The supervisor is entered via the "Portfolio properties" dialog box in the context menu of a portfolio for the respective portfolio version. |

Telephone | The telephone number of the customer advisor from their address. |

Evaluation period | The "Report Performance Report" is prepared for this period. |

Evaluation currency | Currency in which the evaluation is created. You can set this evaluation currency via the report parameters (<CTRL>+<A>). For the default setting, please also read the section Parameters of the standard reports. |

Benchmark | The (first) benchmark stored in the master data of the portfolio or the portfolio version, if such a benchmark is stored, otherwise the entry "no benchmark". |

Asset value Start | The value of the assets on the start date of the evaluation. Specify the start date via the parameters. The default setting is January 1 of the current calendar year. |

Asset value end | Evaluation date set in the parameters. The default setting is the current date. |

Deposits/withdrawals | The difference between all cash deposits and cash withdrawals in the evaluation period. |

Inbound / outbound deliveries | The difference between all securities deliveries and deliveries. |

Portfolio exogenous | The value of cross-portfolio transactions. These are taken into account when calculating performance. |

Taxes paid | Taxes already paid in the evaluation period. |

Change in value | The absolute performance (gross). |

Average available capital | Based on the asset value of the portfolio at the beginning of the evaluation period, the average available capital is calculated as follows: The product of the capital amount and the number of days is calculated for the period for which a certain capital amount was available. The intervals for this calculation are determined by the times of the cash flows or the incoming and outgoing deliveries. The sum of the products determined in this way divided by the length of the evaluation period in days expresses the average available capital. For the exact calculation of the performance, read chapter Calculation of performance. |

Performance since | The percentage performance for portfolio and benchmark (if assigned). The first column provides the percentage performance since the last report to the customer (i.e. depends on the reporting frequency stored in the holder's master data or the portfolio version or the "Reporting frequency start date" parameter), the second column provides the percentage performance since the start of the year (both start dates can be set via the parameters). Also select the performance calculation method in the parameters (<CTRL>+<A>):

|

Unrealized income from securities | The sum of unrealized exchange gains and losses. |

Realized gain on securities | The sum of realized price and foreign exchange gains. |

Income and expenses | The sum of interest, accrued interest, interim profit, dividends, fund distributions and reinvestments, cash flow-related reimbursements, limit fees, advertising costs and other. |

Foreign exchange gain accounts | Any foreign exchange gains realized on foreign currency accounts. |

Change in value | The sum of unrealized profit, realized profit and income and expenses corresponding to the change in value in the performance calculation. |