Asset class analysis report

You can find the "Asset class analysis" report, for example, in the workspace of a portfolio on the "Reporting", "Assets" worksheet.

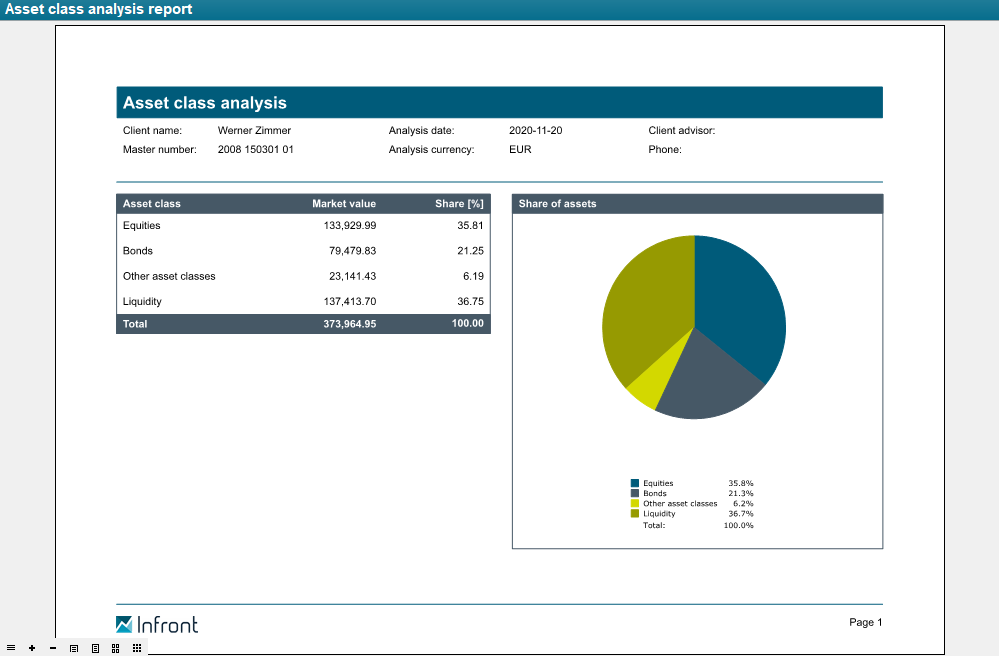

The asset analyses summarize an owner's investments in terms of asset classes, regions, segments and currencies. The asset analyses are comparable with the familiar tabular analyses (types, sectors, countries, currencies), but go a little further: Liquidity is fully integrated and the individual security types are grouped into asset classes, sectors into segments, countries into regions and currencies into currency classes. Special investments (foreign exchange (forward) transactions, fixed-term deposits, loans, margins) form a separate asset class.

This allocation can be adjusted in the Infront Portfolio Manager .

Securities positions that are subject to asset class splitting are allocated to the asset classes on a pro rata basis.

The "Asset class analysis report" summarizes the security types into the following asset classes by default:

- Shares

- Pensions

- Certificates

- Warrants

- Other asset classes

- Liquidity

Securities positions that are subject to asset class splitting are allocated to the asset classes on a pro rata basis.

The asset classes can be customized in the Infront Portfolio Manager with the licensed module "Portfolio Service Extended Portfolio Analysis".