Investment processes

Module "Portfolio Service Investment Agent" or "Portfolio Service Rebalancing" module

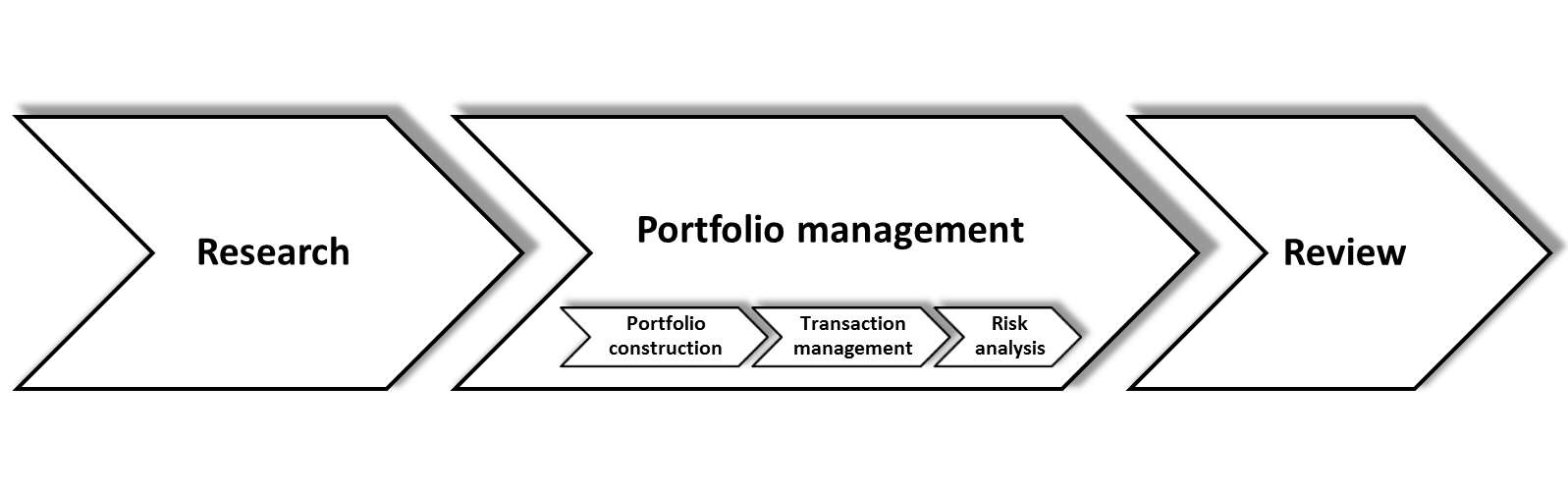

The investment process of an asset management company results from all organizational and content-related requirements that are implemented as part of the investment activities. The aim of the investment process is to implement an asset management mandate, i.e. a mandate profile negotiated with the client (given, for example, by a return expectation (benchmark), risk appetite and a time horizon).

- Mandate profile

- Expected return (benchmark)

- Risk appetite

- Restrictions

- Time horizon

Investment processes should fulfill the characteristics described in the following subsections.

Flexibility

Investment processes must be designed to be flexible enough to accommodate as many different mandate profiles as possible (in terms of benchmark, restrictions, etc.). They cannot be set up and run through separately and specifically for each portfolio; rather, they must be structured in such a way that their results directly imply the "optimal" active structure for each portfolio.

Holistic approach

The individual process modules are connected to each other via interfaces in such a way that decentralized decisions are efficiently coordinated and promptly fed back. It is particularly important to avoid "isolated solutions".

Rule-bound

The decision-making processes are subject to certain rules and principles that the decision-makers (must) follow. This is also referred to as investment discipline.

Repeatability

The process flow can be replicated intertemporally and is largely independent of changes in general conditions, e.g. following staff changes.

Durability

On the one hand, the investment process is strategic in nature, but it can still evolve in line with the investment philosophy.