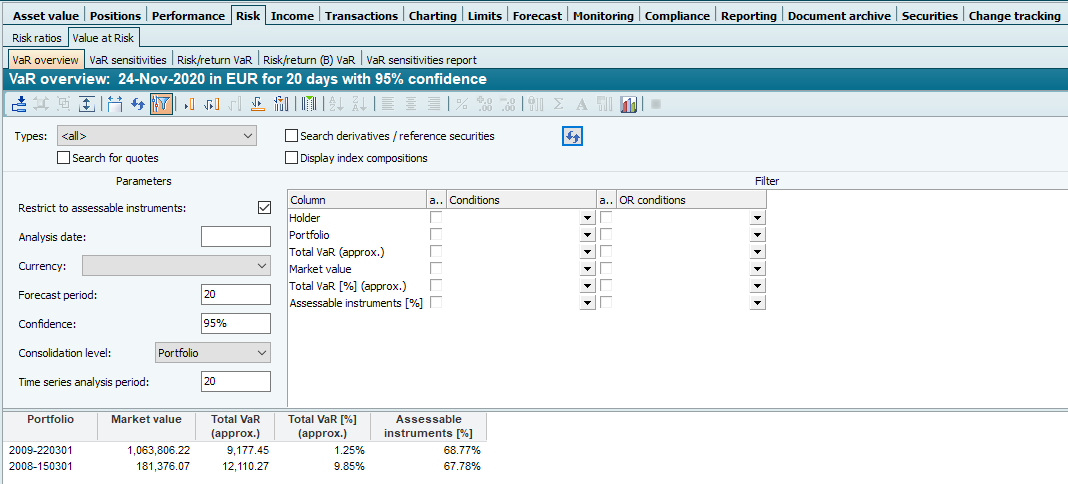

VaR overview

The VaR overview is based on the Simple VaR (SimpleValueAtRisk). This evaluation is used to obtain an overview of the risk situation of portfolios.

When calculating the "Total VaR" column, the standard settlement account is taken into account at the "Depot" consolidation level. At the "Portfolio" and "Holder" consolidation levels, the accounts are taken into account at the respective level.

In the "Total VaR [%]" column, the sum of the value of the assessable (considered) risk positions is used for the calculation.

The column "Valuable instruments [%]" contains the ratio of the value of the measurable risk positions to the assets at consolidation level according to the portfolio valuation. In certain constellations - e.g. with existing loans - values above 100% may also arise here or negative values with negative total assets.

Parameters of the VaR overview

Parameters | Description |

|---|---|

Evaluation date | Evaluation date of the evaluation, which you can enter in the form "dd.mm.yy". The default setting is the current date or the evaluation date entered in the input field on the "Start" tab. |

Currency | Evaluation currency in which the VaR is determined (and against which the exchange rates of the individual instrument currencies are determined). The default setting is the default evaluation currency of the input object (e.g. holder). |

Forecast period | Period for which the VaR is determined (see definition of value at risk). The information is given in periods (trading days). |

Confidence | Probability that the amount of losses in the forecast period will not exceed the VaR. |

Consolidation level | In this selection list, select the consolidation level and specify whether the input object is broken down into portfolios, holders ("Holder"selection) or securities accounts ("Securities account" selection). |

Time seriesanalysistime period | Use this parameter to specify how many periods of the historical time series should be used for parameter estimation. The information is given in periods (trading days). |

Restriction to instruments that can be valued | If you activate this checkbox, the value at risk is only calculated on the measurable instruments, i.e. the result is always a value. Non-valuable instruments are not taken into account. |