Excursus: Interim profits for funds and effects on evaluations

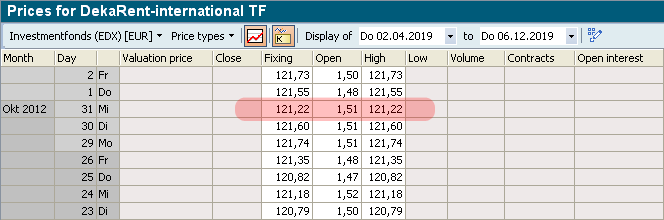

To clarify the relationships, you should first look at the price time series of a fund:

- Search for a fund using the property search or in the Explorer.

- In the context menu (right mouse button) of the fund, select the command WORK PAPER (or COURSE NOTE), EDIT COURSES/FACTORS or press the key combination <CTRL>+<K>.

You will now be shown a table of the fund's prices.

A special feature of funds is the following:Spot = redemption price

Open = interim profit

High = Issue price

- Now call up an asset overview containing this fund.

In the "Price" column you will find the redemption price of the fund in the default setting of the parameters:

To exclude interim profits in the balance sheet, deactivate the "Include interim profits" parameter and re-evaluate the balance sheet. The example then shows a price of EUR 123.16.

Net price = gross price (redemption price) - interim profit

The redemption price is displayed in the chart, which corresponds to the value in the "Price" column of the asset overview with the "Include interim profits" parameter activated.

Explanation

The interim profit of a fund is included in the issue or redemption price. When determining profits, the question arises as to whether the difference between the gross prices or the net prices should be used for the calculation. Since the interim profit on the sale is fixed, the realized P&L and the private capital gain are calculated using the net prices. The setting of the "Include intercompany profits" parameter is decisive for the calculation of unrealized profits.

Until the end of 2017, interim profits were only delivered in the exchange rate system for the EAX (Kontrollbank ÖKB fund trading), EDX (investment funds) and KAG (fund trading market maker) positions. For the other places, a request for interim profit always returned 0.

As a result, the interim profit of an open fund position without this data delivery was shown twice in the performance report: once as part of the unrealized profit and once as interest under the heading "Income and expenses". After closing out the Position, however, consistency was restored, as the realized P&L is calculated on the net prices as described above.

As of January 1, 2018, the separate calculation and taxation of interim profits was abolished by the Investment Tax Act .