Calculation methods

There are various methods for calculating performance, which normally produce results that differ greatly from one another. There is no general answer as to which method is the right or wrong one, but it depends on how you look at it.

The reason for the emergence of different methods for calculating portfolio performance is capital flows during the period under review. Capital flows include cash deposits, cash withdrawals and securities deposits and deliveries.

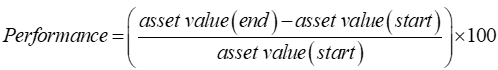

Without capital flows, the calculation is undisputed (basic formula for calculating performance):

The terms "end" and "start" refer to the limits of the period under review. Depending on how capital flows are to be included in the performance calculation, a distinction is made between money-weighted (classic) and time-weighted performance.

While the time-weighted method does not take into account the average capital available in the period under review in any way, which can lead to performance values that are difficult to explain, the money-weighted (classic) performance reflects the increase in value of a portfolio in a form that is comprehensible to the holder.

On the other hand, the calculation of the money-weighted performance is an approximate solution. The time-weighted method abstracts from the points in time of the capital flows and calculates exact partial performance values in the time intervals between the capital flows. The overall performance is determined by geometrically linking the partial performance values. As the timing of the capital flows is usually not the responsibility of the portfolio manager, the time-weighted performance documents the performance of the portfolio manager.

Infront Portfolio Manager can use both the classic, money-weighted method for calculating portfolio performance and the time-weighted method.